Initiating Coverage | Plywood

March 03, 2018

Greenply Industries

BUY

The plywood maker for growing India

CMP

`340

Greenply Industries Ltd (GIL) manufactures plywood & allied products and medium

density fibreboards (MDF). GIL offers a portfolio of residential and commercial

Target Price

`395

products comprising plywood & block boards, MDF, wood floors, flush doors and

Investment Period

12 Month

decorative veneers. GIL offers wood floors under the brand name Green Floormax.

Currently, GIL has ~26% market share in the organized plywood industry.

Stock Info

Shifting of trend towards the organized plywood sector to propel growth: Indian

Sector

Plywood

plywood industry is estimated at `18,000cr (largely unorganised), and accounts for

Market Cap (` cr)

4,155

~75% share of revenues. With the implementation of GST, the share of organized

Net Debt (` cr)

413

players is expected to improve, which would benefit branded players like GIL. Hence,

Beta

1.0

we believe that GIL is best placed to gain market share on the back of better product

52 Week High / Low

401/255

quality, strong brands and wide distribution network. Currently, the company has

Avg. Daily Volume

57,987

~26% market share in the organized plywood industry.

Face Value (`)

1

BSE Sensex

34,047

Capacity addition in MDF segment a growth catalyst: GIL has added new MDF plant

Nifty

10,458

in Andhra Pradesh, which would increase the capacity from 1,80,000 CBM to

Reuters Code

GRPL.BO

540,000 CBM (new plant can generate revenue of `800-900cr). Total capex required

Bloomberg Code

MTLM.IN

for this MDF plant is `700cr out which the company has already spent ~`550cr till

1HFY18 and the balance would be spent by FY2019. The commercial production

Shareholding Pattern (%)

would start from 2QFY19, boosting the company’s profitability. Currently the company

Promoters

51.0

has ~30% market share in MDF.

MF / Banks / Indian Fls

20.6

Pradhan Mantri Awas Yojana (PMAY) - trigger for MDF segment: The government has

FII / NRIs / OCBs

14.9

set an aim to build ~1.2cr houses by 2022 under PMAY, which would increase the

Indian Public / Others

13.5

demand for plywood industry for making doors and furniture. Moreover, in the lower

segment, demand for MDF would increase for these houses.

Abs.(%)

3m

1yr

3yr

Strong brand visibility with wide distribution network: GIL has been continuously

Sensex

3.7

17.5

15.6

focusing on strong brand visibility. Historically, the company has been spending

GIL

8.0

18.9

85.4

around 3% (% of sales) on ad spends to increase its brand visibility. Currently, GIL’s

products (Plywood and MDF) are available across India through 30-35 branches,

which address more than 2,000 dealers and nearly 10,000 retailers.

3-year price chart

Outlook and Valuation: We expect GIL to report net revenue CAGR of ~14% to

~`2,478cr over FY2017-20E mainly due to healthy growth in plywood & lamination

450

business and MDF (capacity expansion) on the back of strong brand and distribution

400

350

network. On the bottom-line front, we expect ~13% CAGR to `179cr over the same

300

period owing to strong revenue and better margins in MDF business. At the current

250

200

market price of `340, the stock trades at PE of 23.3x its FY2020E EPS of `14.6. We

150

initiate coverage on GIL with Buy recommendation and Target Price of `395 (27x

100

50

FY20E EPS), indicating an upside of ~16% from the current levels.

0

Key financials

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

Source: Company, Angel Research

Net sales

1,664

1,711

2,188

2,478

% chg

1.0

2.8

27.9

13.2

Net profit

125

135

161

179

% chg

(1.9)

7.7

19.2

11.4

EBITDA margin (%)

14.5

14.5

15.6

15.7

EPS (`)

10.2

11.0

13.1

14.6

P/E (x)

33.2

30.9

25.9

23.3

Amarjeet S Maurya

P/BV (x)

5.4

4.6

3.9

3.3

022-39357800 Ext: 6831

RoE (%)

16.2

14.9

15.1

14.4

RoCE (%)

16.3

13.6

16.6

16.3

EV/Sales (x)

2.7

2.7

2.1

1.8

EV/EBITDA (x)

18.5

18.7

13.5

11.6

Source: Company, Angel Research, Note: CMP as of March 1, 2018

Please refer to important disclosures at the end of this report

1

Greenply Industries| Initiating Coverage

Outlook and Valuation

We expect GIL to report net revenue CAGR of ~14% to ~`2,478cr over FY2017-20E

mainly due to healthy growth in plywood & lamination business and MDF (capacity

expansion) on the back of strong brand and distribution network. On the bottom-line

front, we expect ~13% CAGR to `179cr over the same period owing to strong revenue

and better margins in MDF business. At the current market price of `340, the stock

trades at PE of 23.3x its FY2020E EPS of `14.6. We initiate coverage on GIL with Buy

recommendation and Target Price of `395 (27x FY20E EPS), indicating an upside of

~16% from the current levels.

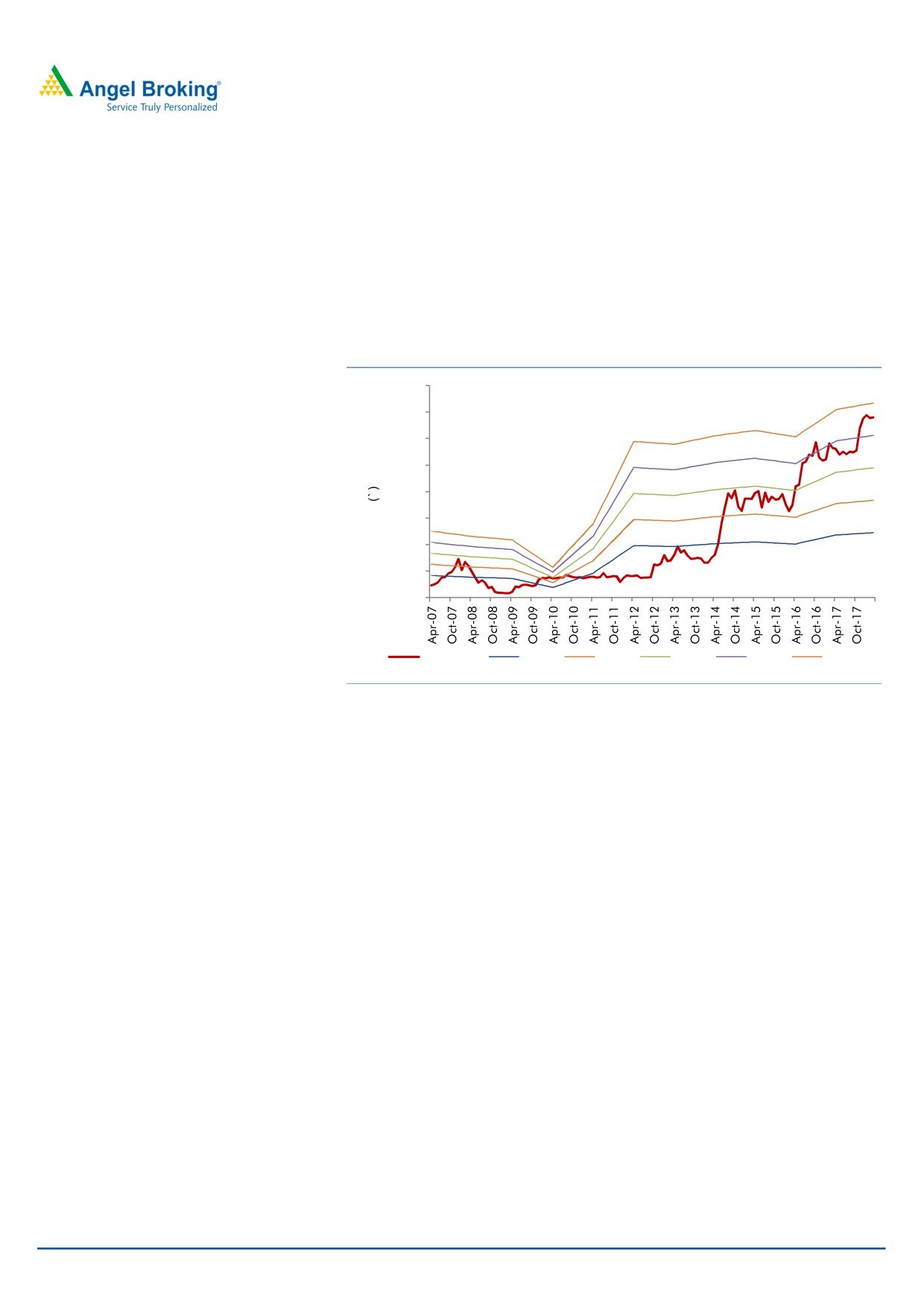

Exhibit 1: One year forward PE Chart

400

350

300

250

200

150

100

50

0

Share Price

10.0 X

15.0 X

20.0 X

25.0 X

30.0 X

Source: Company, Angel Research

Risks to our estimates

Most of the company’s raw material is imported from other countries. The

company also has ECB loan, hence any unfavorable change in currency may pose

forex risks, which could significantly impact GIL’s margins.

The company is expanding the MDF plant with capex of ~`700cr, any slowdown

in MDF market can impact the company’s earnings due higher fixed cost

overheads.

March 03, 2018

2

Greenply Industries| Initiating Coverage

Company Background

Greenply Industries Limited is engaged in the business of manufacturing plywood &

allied products and medium density fibreboards (MDF) through its factories at various

locations. The company's segments include Plywood & Allied Products and Medium

Density Fibre Boards & Allied Products. The Plywood & Allied Products segment is

engaged in the business of manufacturing and trading of Plywood, block boards,

veneer, doors and other wood panel products through its wholesale and retail network.

The Medium Density Fibre Boards & Allied Products segment is engaged in the business

of manufacturing of Medium Density Fibreboards and other allied products through its

wholesale and retail network. The company offers a portfolio of residential and

commercial products comprising plywood and block boards, MDF, wood floors, flush

doors and decorative veneers. The company offers wood floors under the brand name

Green Floormax.

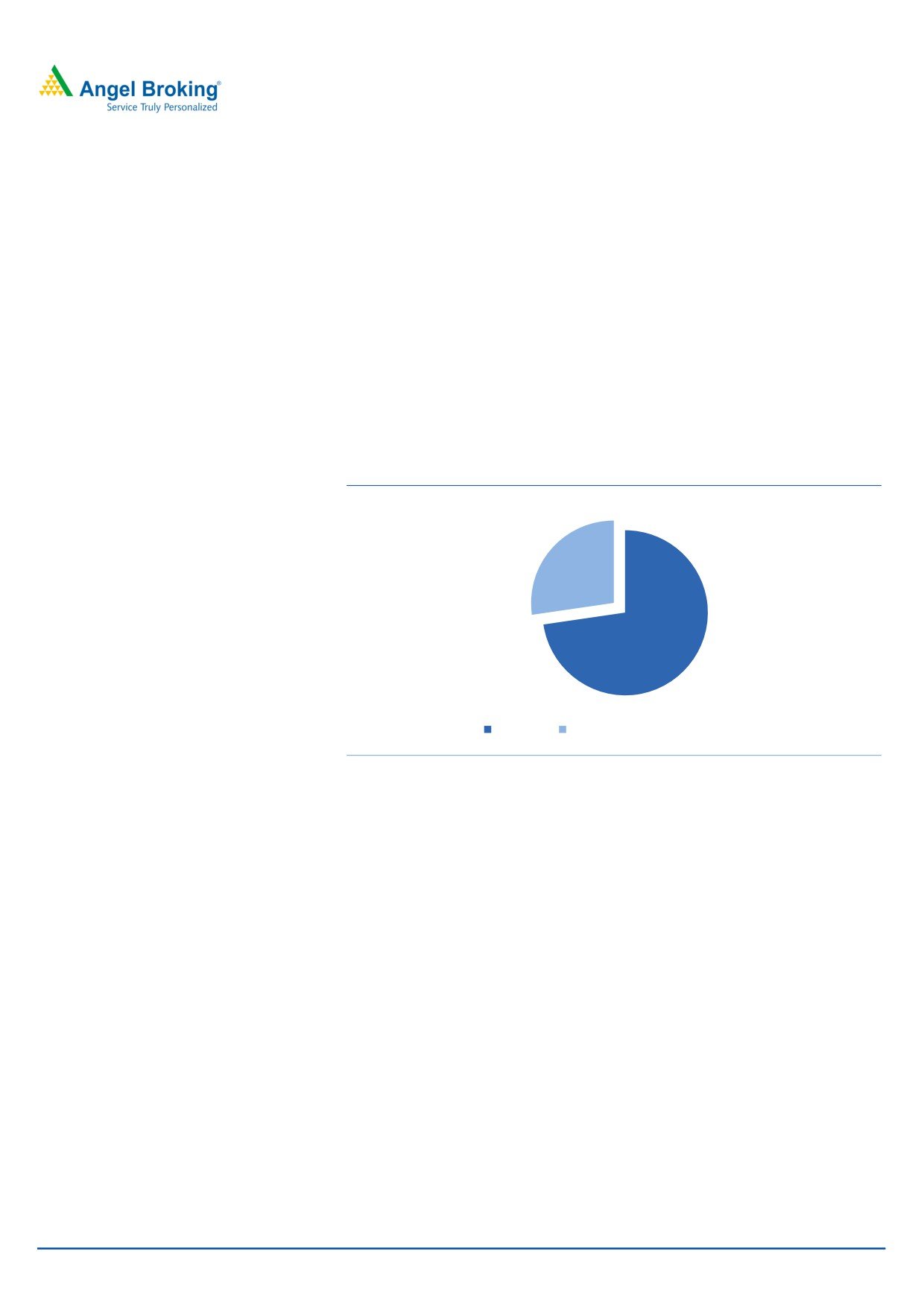

Exhibit 2: Revenue break-up for FY2017

27%

73%

Plywood

Medium Density Fireboard (MDF)

Source: Company, Angel Research

March 03, 2018

3

Greenply Industries| Initiating Coverage

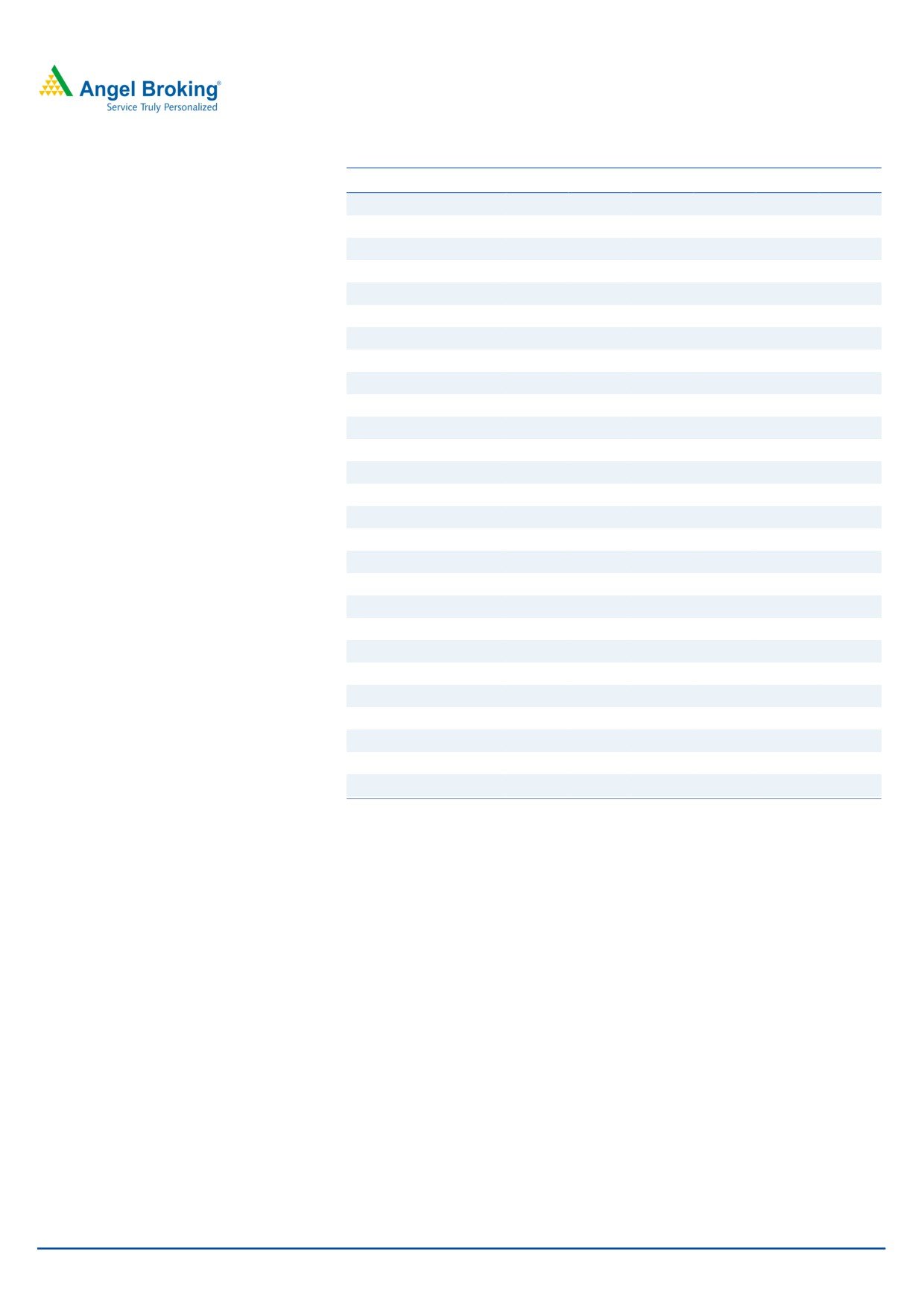

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

1,564

1,647

1,664

1,711

2,188

2,478

% chg

(29.4)

5.3

1.0

2.8

27.9

13.2

Total Expenditure

1,359

1,409

1,423

1,463

1,847

2,089

Raw Material

909

920

883

907

1,160

1,313

Personnel

145

167

177

183

239

273

Others Expenses

305

321

362

373

449

503

EBITDA

205

239

241

248

341

389

% chg

(22.6)

16.6

0.9

3.0

37.6

13.9

(% of Net Sales)

13.1

14.5

14.5

14.5

15.6

15.7

Depreciation& Amortisation

47

50

51

52

75

98

EBIT

158

189

190

196

266

291

% chg

(23.0)

19.9

0.6

3.0

35.8

9.2

(% of Net Sales)

10.1

11.5

11.4

11.5

12.2

11.7

Interest & other Charges

36

29

19

13

43

43

Other Income

19

10

10

10

10

12

(% of PBT)

13.7

5.9

5.5

5.2

4.3

4.6

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

141

170

181

193

233

260

% chg

(7.6)

20.2

6.9

6.4

20.9

11.4

Tax

17

41

56

58

72

81

(% of PBT)

12.0

24.4

30.8

30.0

31.0

31.0

PAT (reported)

124

128

125

135

161

179

% chg

5.7

3.0

(1.9)

7.7

19.2

11.4

(% of Net Sales)

7.9

7.8

7.5

7.9

7.4

7.2

Basic EPS (`)

10.1

10.4

10.2

11.0

13.1

14.6

Fully Diluted EPS (`)

10.1

10.4

10.2

11.0

13.1

14.6

% chg

5.7

3.0

(1.9)

7.7

19.2

11.4

Source: Company, Angel Research

March 03, 2018

4

Greenply Industries| Initiating Coverage

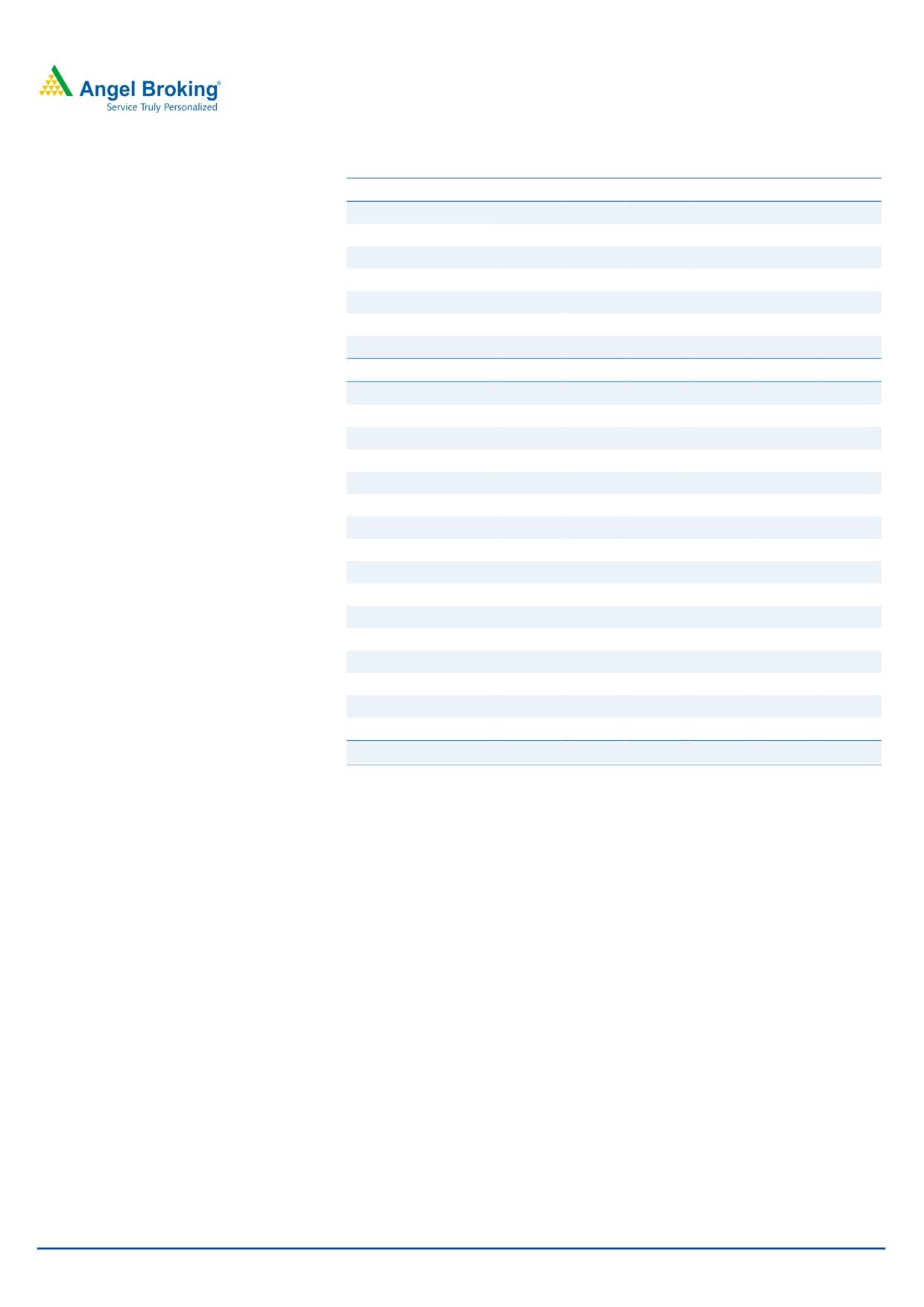

Consolidated Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

12

12

12

12

12

12

Reserves& Surplus

474

602

760

895

1,056

1,236

Shareholders Funds

486

614

773

908

1,069

1,248

Minority Interest

-

-

-

-

-

-

Total Loans

332

270

397

536

536

536

Deferred Tax Liability

49

50

49

49

49

49

Total Liabilities

867

935

1,218

1,493

1,654

1,833

APPLICATION OF FUNDS

Gross Block

726

774

797

807

1,507

1,517

Less: Acc. Depreciation

193

232

272

324

399

497

Net Block

533

542

526

484

1,109

1,020

Capital Work-in-Progress

14

9

269

620

-

-

Investments

35

29

26

26

26

26

Current Assets

567

620

757

739

1,006

1,315

Inventories

190

139

158

173

228

285

Sundry Debtors

257

333

302

319

420

496

Cash

8

35

78

41

85

163

Loans & Advances

97

74

66

68

98

136

Other Assets

15

40

153

137

175

235

Current liabilities

291

316

395

410

522

563

Net Current Assets

276

304

363

328

484

752

Deferred Tax Asset

9

50

35

35

35

35

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

867

935

1,218

1,493

1,654

1,833

Source: Company, Angel Research

March 03, 2018

5

Greenply Industries| Initiating Coverage

Consolidated Cashflow Statement

Y/E March (` cr)

FY2015 FY2016 FY2017 FY2018E FY2019E FY2020E

Profit before tax

141

170

181

193

233

260

Depreciation

47

50

51

52

75

98

Change in Working Capital

(9)

(21)

(25)

(2)

(112)

(190)

Interest / Dividend (Net)

35

28

18

13

43

43

Direct taxes paid

(28)

(38)

(42)

(58)

(72)

(81)

Others

1

2

(0)

0

0

0

Cash Flow from Operations

187

191

183

198

167

131

(Inc.)/ Dec. in Fixed Assets

(86)

(69)

(295)

(10)

0

(10)

(Inc.)/ Dec. in Investments

(19)

6

2

(345)

(80)

0

Cash Flow from Investing

(105)

(63)

(293)

(355)

(80)

(10)

Issue of Equity

0

0

50

0

0

0

Inc./(Dec.) in loans

(47)

(64)

129

139

0

0

Dividend Paid (Incl. Tax)

(7)

(7)

(7)

0

0

0

Interest / Dividend (Net)

(29)

(29)

(22)

(13)

(43)

(43)

Cash Flow from Financing

(82)

(100)

150

126

(43)

(43)

Inc./(Dec.) in Cash

1

28

40

(30)

44

78

Opening Cash balances

3

3

31

71

41

85

Closing Cash balances

3

31

71

41

85

163

Source: Company, Angel Research

March 03, 2018

6

Greenply Industries| Initiating Coverage

Key ratios

Y/E March

FY2015 FY2016 FY2017FY2018EFY2019EFY2020E

Valuation Ratio (x)

P/E (on FDEPS)

33.6

32.6

33.2

30.9

25.9

23.3

P/CEPS

24.3

23.4

23.7

22.3

17.7

15.0

P/BV

8.6

6.8

5.4

4.6

3.9

3.3

Dividend yield (%)

0.2

0.0

20.6

0.0

0.0

0.0

EV/Sales

2.8

2.7

2.7

2.7

2.1

1.8

EV/EBITDA

21.8

18.3

18.5

18.7

13.5

11.6

EV / Total Assets

5.1

4.7

3.7

3.1

2.8

2.5

Per Share Data (Rs)

EPS (Basic)

10.1

10.4

10.2

11.0

13.1

14.6

EPS (fully diluted)

10.1

10.4

10.2

11.0

13.1

14.6

Cash EPS

14.0

14.5

14.4

15.3

19.3

22.6

DPS

0.6

0.0

70.0

0.0

0.0

0.0

Book Value

39.7

50.1

63.0

74.0

87.2

101.8

Returns (%)

ROCE

19.3

21.4

16.3

13.6

16.6

16.3

Angel ROIC (Pre-tax)

20.4

23.0

17.9

14.2

17.8

18.2

ROE

25.5

20.8

16.2

14.9

15.1

14.4

Turnover ratios (x)

Asset Turnover (Gross Block)

2.2

2.1

2.1

2.1

1.5

1.6

Inventory / Sales (days)

44

31

35

37

38

42

Receivables (days)

60

74

66

68

70

73

Payables (days)

53

55

66

66

66

64

Working capital cycle (ex-cash) (days)

51

49

35

39

42

51

Source: Company, Angel Research

March 03, 2018

7

Greenply Industries| Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Greenply Industries

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 03, 2018

8